Don’t Forget to Claim Green Tax Credits

Join the community

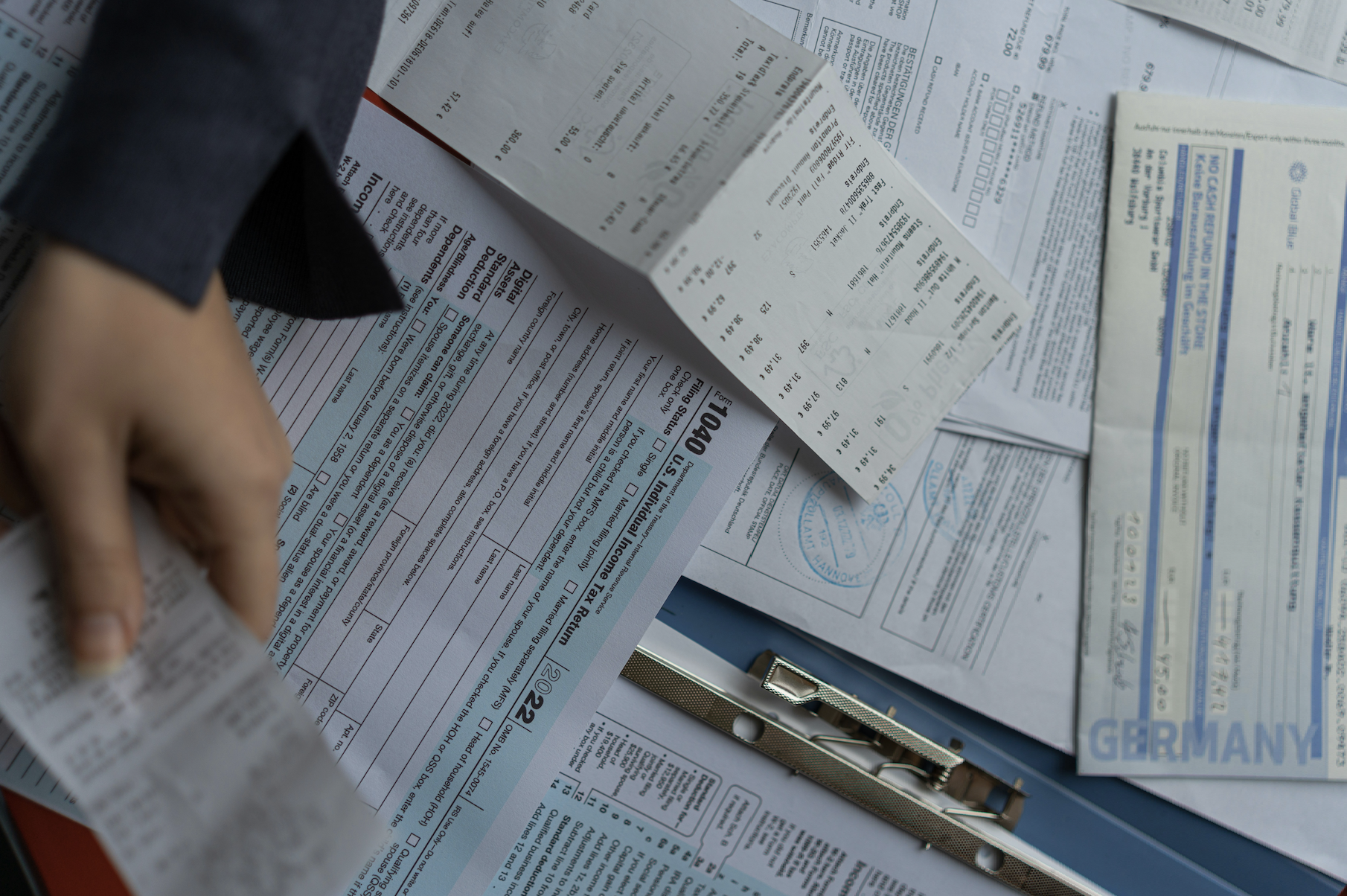

If you’ve started working on your 2025 tax return, now’s the time to be sure you’re claiming all the tax credits you qualify for.

Tax credits reduce your federal tax bill dollar-for-dollar, and many credits relate to actions you took last year — from buying clean energy equipment to going back to school.

Below is a guide to the most important sustainable credits that apply to the 2025 tax year.

Clean Energy & Home Efficiency Tax Credits

Residential Clean Energy Credit

If in 2025, you installed solar panels, wind turbines, battery storage, geothermal heat pumps or other qualifying clean energy systems on your home, you might be eligible for the Residential Clean Energy Credit (formerly the Solar Investment Tax Credit, Sec. 25D).

This credit generally equals 30% of your qualifying costs (including labor) for property “placed in service” — meaning installed and ready to use during the 2025 tax year.

How to claim: Attach IRS Form 5695 to your Form 1040 for the 2025 tax filing and enter your qualified expenses.

Deadline: Your system must be installed and placed in service by December 31, 2025. Credits aren’t available for systems put into service in 2026 or later.

Energy Efficient Home Improvement Credit

This credit helps offset the costs of more efficient home upgrades you made in 2025, like insulation, windows, doors, heat pumps, or water heaters. It gives tax savings of up to 30% of the cost, subject to annual limits. Like the clean energy credit, these improvements must be installed in 2025.

How to claim: Also on Form 5695, Part II, along with your federal return.

Deadline: Both this credit and the residential clean energy credit expire after December 31, 2025. Any improvements installed in 2026 won’t qualify.

Electric Vehicle (EV) & EV Charger Tax Credits

Electric Vehicle (EV) Tax Credits

If you bought a qualifying electric vehicle in 2025, you may have been able to claim a federal EV tax credit of up to $7,500 for new vehicles and up to $4,000 for used EVs. These credits ended September 30, 2025, under legislation passed mid-year.

If you took delivery of your EV before that deadline and meet the IRS requirements, you can still include that credit on your 2025 tax return.

How to claim: Use IRS Form 8936 with your 2025 tax return. Your dealer may have provided documentation you’ll need to support the credit.

EV Charger Credit

If you installed a home EV charging station in 2025, you might qualify for a credit of 30% of the cost (up to $1,000). This credit runs through June 30, 2026 — so if your charger was installed by the end of 2025, it definitely qualifies on your 2025 return.

How to claim: This credit is claimed on IRS Form 8911 along with your income tax return.

Education Credits

If you (or a dependent) paid tuition for college or other qualifying education in 2025, you might be eligible for the American Opportunity Tax Credit (up to $2,500) or the Lifetime Learning Credit (up to $2,000). These credits can significantly lower your tax bill for education costs.

How to claim: Education credits are claimed on Form 8863 with your federal return.

Tips to Claim Credits Correctly

Gather Documentation Early

For energy credits and EV purchases, keep receipts, installation or delivery dates, and any manufacturer/dealer certification. The IRS may not require you to attach all documents, but you must retain them in case of an audit.

Use the Right IRS Forms

- Form 1040: Your main federal income tax return.

- Form 5695: For residential energy and efficiency credits.

- Form 8936: For EV credits.

- Form 8911: For EV charger credits.

Filing Deadlines

The typical deadline for filing your 2025 federal tax return is April 15, 2026. If you need more time, you can request an extension with Form 4868.