How to Divest Your 401(k) from Fossil Fuels

Join the community

The following information is intended for educational purposes and does not constitute investment advice.

The average American has a 401(k) balance of $160,000 by the time they’re in their fifties. These assets play an outsized role in our lifetime financial influence. In fact, around half of us invest in almost nothing else.

But only 0.1% of 401(k) funds are invested in socially and environmentally responsible companies. And what we do fund is an even bigger problem. Research suggests the average person has invested $6,000 in fossil fuels through their retirement savings.

Divesting your 401(k) sounds daunting, but it’s worth it. If we don’t rapidly divest from fossil fuels, we won’t have a retirement to look forward to. Plus, you only have to do it once. When you're ready to divest your 401k from fossil fuels, there are three steps to take:

- Green your current 410(k)

- Find and transfer your old 401(k)s

- Lobby for sustainable retirement funds

1. Green Your Current 401(k)

Assessing your existing 401(k) to understand what you’re invested in and how you can align your portfolio with your values. Only 2.8% of 401(k) accounts offer sustainable investing options, so it's likely you're invested in fossil fuels.

First, you’ll want to take a closer look at your 401(k). If you’re not sure who manages your account, contact your HR department to find out. You can access information about your specific 401(k) through that institution’s employee portal.

Next, find out what you’re invested in. Use fossilfreefunds.org to check the fossil fuel exposure of each fund in your account. This tool rates individual funds from A to F.

If you don’t like what you find, you have three main options. You can:

- Move to a fossil fuel-free investment fund within your current 401(k)

- Switch to a self-managed brokerage fund

- Modify your current 401(k) to do less damage

Your best option depends on your investing background and the plans available to you. Any action to green your 401(k) is a step in the right direction since every bit of change matters!

Option One: Move to a Fossil-Fuel Free Investment Fund

Your biggest power move is to divest your 401(k) from fossil fuels completely. Ask your plan manager if your company offers any fossil fuel-free funds within its current offerings. If it does, initiate a transfer and you will be all set.

Option Two: Switch to Self-Managed Brokerage

If your plan doesn’t offer fossil fuel-free options, they may offer a brokerage window that gives you the flexibility to pick the funds in your retirement portfolio yourself. You can select sustainable retirement funds at your own discretion, using tools like fossilfreefunds.org as a guide.

This flexibility comes with greater risk, and self-directed funds are better suited for experienced investors. If you have limited financial know-how, consider working with a financial advisor to determine which funds are smart investments for your future.

Option Three: Modify Your Current 401(k) to Do Less Damage

Many workplaces don’t offer 401(k)s with fossil fuel-free options. If yours doesn’t, and you don’t feel comfortable opting for self-brokerage, you can still modify the composition of your current 401(k) plan to do less damage.

A great place to start is by asking if your company offers any Environmental, Social, and Governance (ESG)-oriented funds. Although the term ESG is not strictly regulated, these funds are often far better than the status quo.

If your employer doesn’t offer ESG options, do a little digging to uncover the most sustainable funds available within your current plan. Your 401(k) may offer non-ESG funds that invest in green energy or other sustainable industries. Switching to these funds helps finance companies working to decarbonize the world at scale, even if a portion of your savings still supports fossil fuels.

If you strike out on the first two options, you can still switch to the funds that are the least bad by checking which score highest on fossil fuel-free funds.

2. Find and Transfer Your Old 401(k)s

Research shows that we switch employers 12 times on average by the time we’re 50 years old. This means you probably have an old 401(k) (or ten) floating around. And since neither you nor your past employer is actively contributing to these accounts, you’re free to send these investments to greener pastures.

First, locate any inactive 401(k) accounts from past employers. If you’re not sure where they live, the easiest way to find them is to contact the HR department from your old job. Once you’ve located your accounts, it’s time to get your retirement savings working for the planet.

While it’s important to do your own research, organizations like Carbon Collective make it easy to roll over your 401(k)s into fossil-fuel-free investment portfolios. Click the link above to learn more, and follow the steps below to make the switch.

Carbon Collective

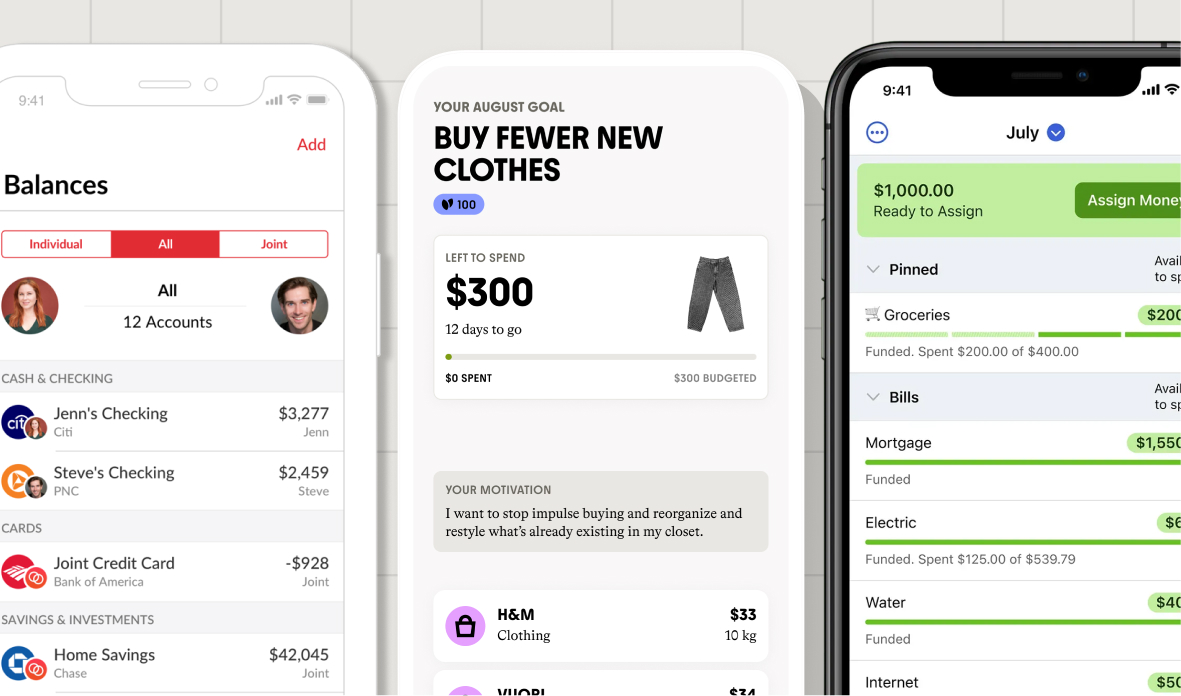

- To transfer your 401(k) to Carbon Collective, you’ll need to sign up with their investment platform.

- First, you’ll answer a few questions about your investing goals to help you choose the right account type.

- Then, you’ll get an invite to set up an account on Altruist, Carbon Collective’s brokerage software partner.

- Lastly, you can make an initial deposit by contacting your 401(k) institution and initiating a “direct rollover” to that account.

Learn more about rolling over your 401(k) to Carbon Collective

3. Lobby for Sustainable Retirement Funds

The small changes we make in our personal lives are important. But with nearly $7 trillion held in 401(k)s in the United States, changing the system could change the world.

When you lobby your current employer to offer sustainable retirement funds, you make it easier for every person in your workplace to green their 401(k)s. Try this plan of action:

- Identify Decision-Makers: Contact your plan administrator and chief sustainability officer (even your CEO if you work at a smaller company) and ask to start a conversation about green investment options.

- Call in Backup: There’s power in numbers, so share what you’ve learned and round up like-minded colleagues. If your company has a green team, bring your concerns to them. If not, it might be time to start one!

- Prepare Your Evidence: Employers want to limit risk, but investing in fossil fuels is a poor long-term bet for their employees and the planet. Plus, there’s compelling evidence that ESG funds are actually more stable than traditional funds, according to a 2019 analysis by Morgan Stanley.

- Propose a Concrete Solution: Getting sustainable retirement funds can take time, but offering solutions can speed up the process. Sphere’s fossil-free index, Carbon Collective, or even any fund in your current plan that’s nearly fossil-free are great options to consider.

Get savvy on 401k's and fossil fuels

Want to learn more about how retirement savings' connection to the climate crisis? Here's some additional resources to dig into: